2025 Irs Estimated Tax Payment Form

2025 Irs Estimated Tax Payment Form. It’s important to note that taxpayers. If you miss one, make the quarterly tax payment as soon as you.

Discover everything about irs estimated tax payments for 2025. If you miss one, make the quarterly tax payment as soon as you.

Learn What They Are, Due Dates, Who Should Pay, How To Calculate And Make Payments.

Make payments from your bank account for your balance,.

Learn How And When To Make An Estimated Tax Payment In 2025 — Plus Find Out Whether You Need To Worry About Them In The First Place.

How to make estimated tax payments and due dates in 2025.

2025 Irs Estimated Tax Payment Form Images References :

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

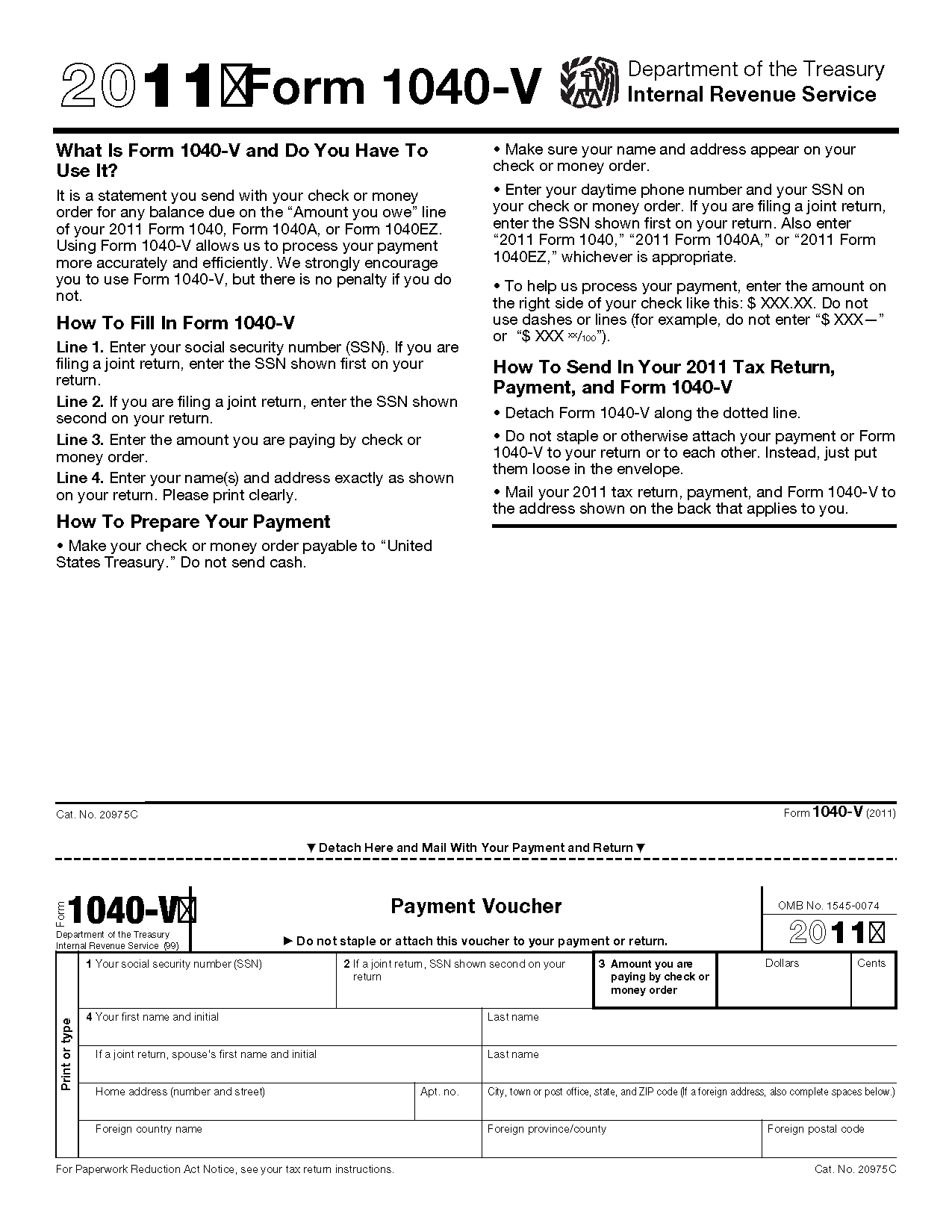

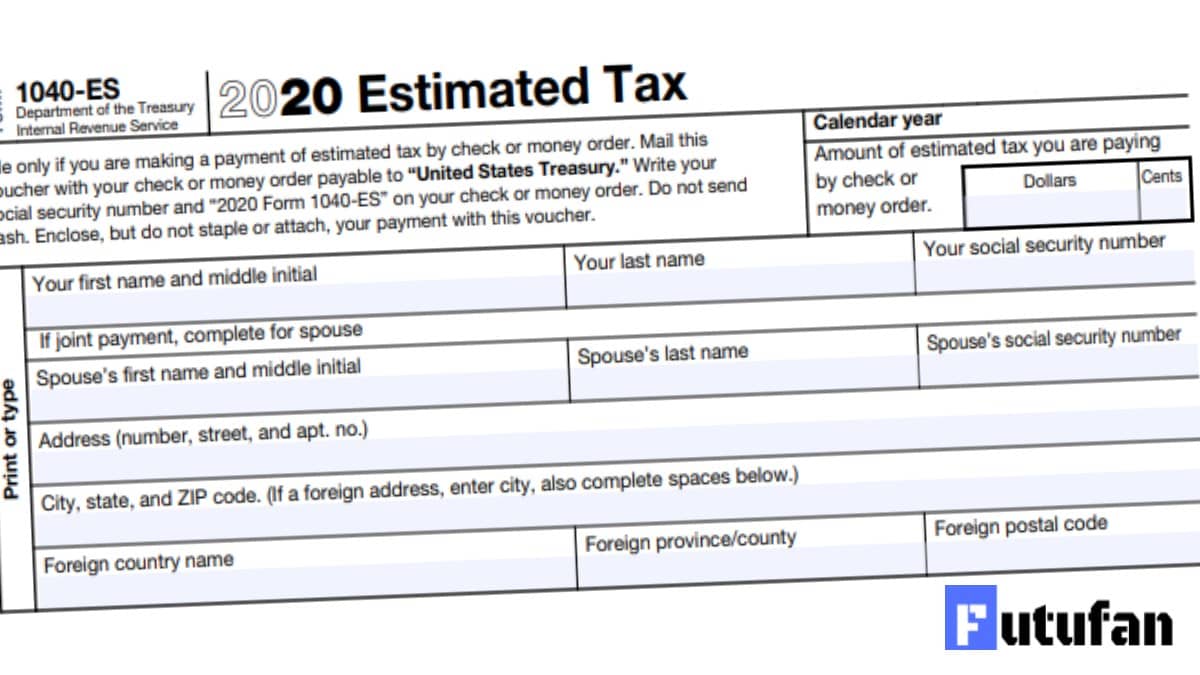

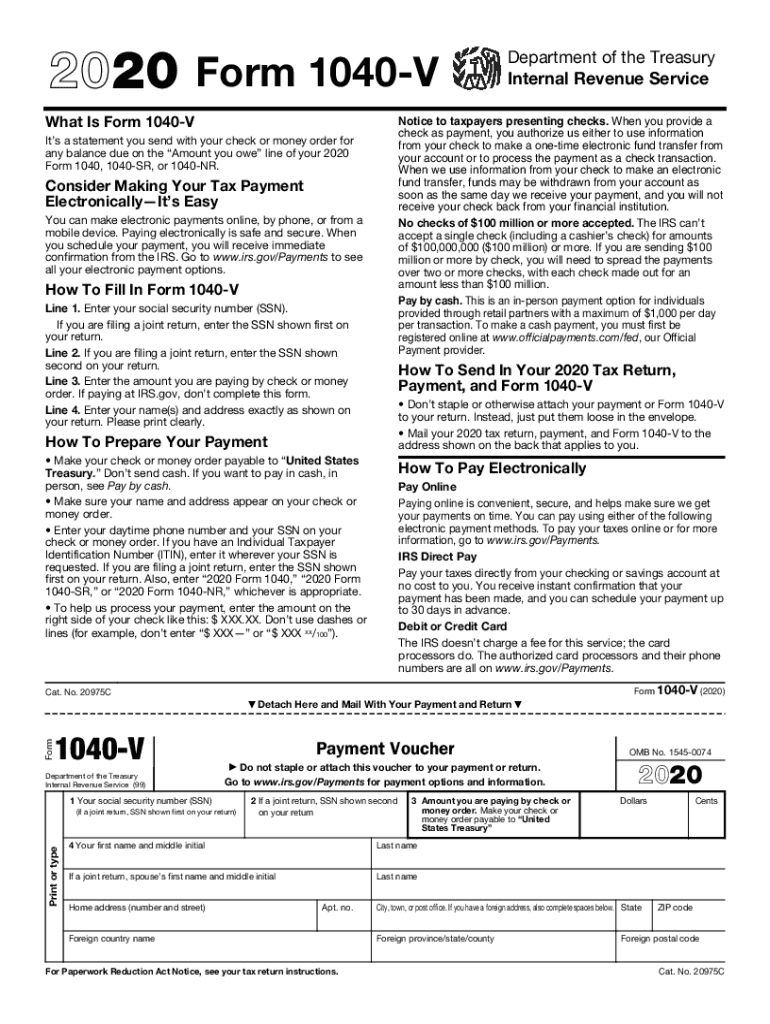

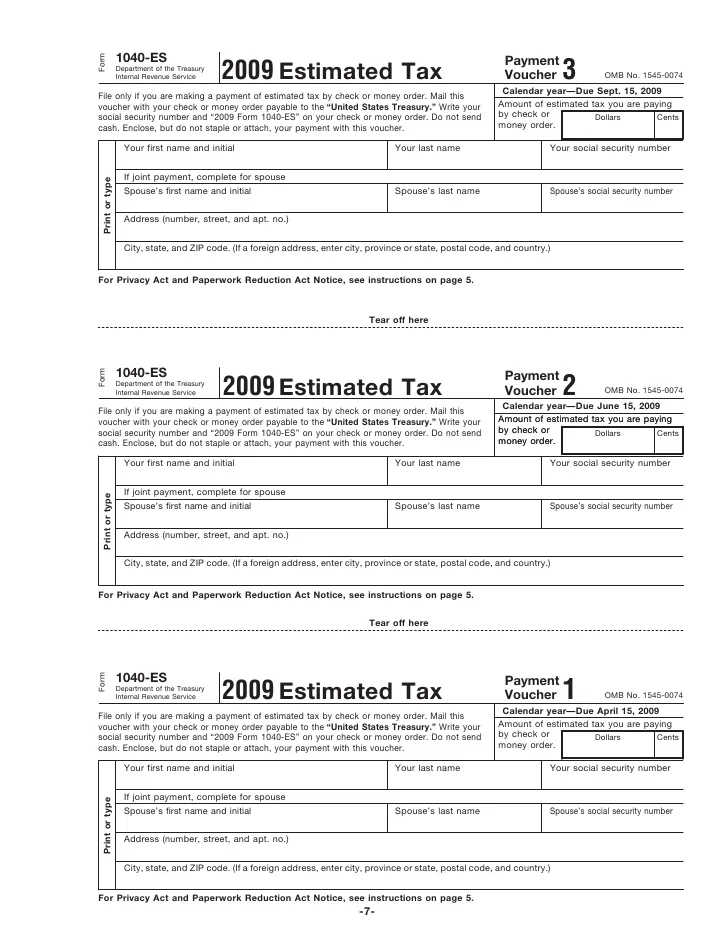

Irs Estimated Tax Payment Forms 2025 Genni Heloise, Learn what they are, due dates, who should pay, how to calculate and make payments. If your income varies throughout the year, you can estimate your tax burden based on your income and deductions in the previous quarter.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Irs Estimated Tax Payment Form 2025 Online Sonni Celestyn, There are four payment due dates in 2025 for estimated tax payments: Final payment due in january 2025;

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

State Of Maryland Estimated Tax Payments 2025 ashly lizbeth, Learn who can file it, how. Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments.

Source: www.vrogue.co

Source: www.vrogue.co

Irs Form 1040 Es Online 1040 Form Printable vrogue.co, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.

Source: williamperry.pages.dev

Source: williamperry.pages.dev

W4 2025 Form Irs Dotty Johannah, Final payment due in january 2025; You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps).

Source: williamperry.pages.dev

Source: williamperry.pages.dev

2025 Form 1040 Es Payment Voucher Maiga Roxanna, You can pay your estimated taxes online through your irs account, the irs2go app, irs direct pay, or the electronic federal tax payment system (eftps). It’s important to note that taxpayers.

Source: www.youtube.com

Source: www.youtube.com

How to calculate estimated taxes 1040ES Explained! {Calculator, If you miss one, make the quarterly tax payment as soon as you. It’s important to note that taxpayers.

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

Estimated Tax Payments 2025 Irs Form Sibyl Dulciana, Alternatives to mailing your estimated tax payments to the irs; Final payment due in january 2025;

Source: nataliejones.pages.dev

Source: nataliejones.pages.dev

Irs Estimated Tax Payment Form 2025 Deana Estella, People with complex tax situations should instead use the instructions in publication 505, tax withholding and estimated tax. Learn what they are, due dates, who should pay, how to calculate and make payments.

Source: kimwmelton.pages.dev

Source: kimwmelton.pages.dev

Mo Estimated Tax Payments 2025 Amara Bethena, If you earn taxable income in august 2025, you don’t have to pay estimated taxes until september 16, 2025. First, determine your expected adjusted gross income (agi), taxable income, taxes, deductions, and credits for the year.

Make Payments From Your Bank Account For Your Balance,.

The irs estimated tax worksheet can help you do.

If You Earn Taxable Income In August 2025, You Don’t Have To Pay Estimated Taxes Until September 16, 2025.

Use direct pay to securely pay form 1040 series, estimated or other individual taxes directly from your checking or savings account at no cost.

Category: 2025